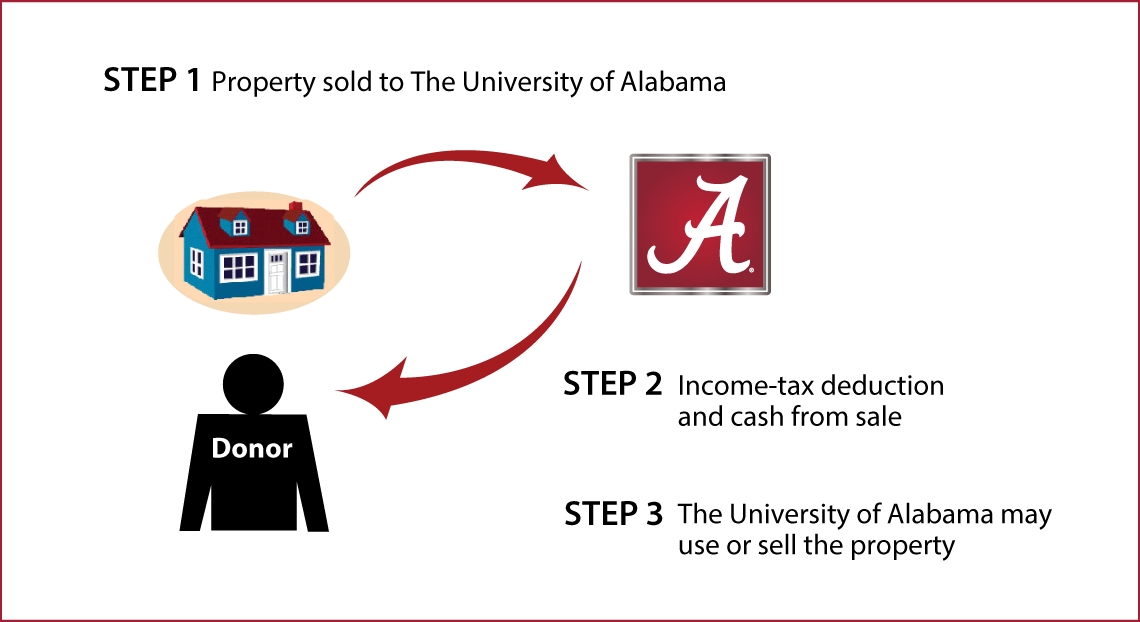

Real Estate—Bargain Sale

How It Works

- You sell property to The University of Alabama for less than its fair-market value—usually what you paid for it

- The University of Alabama pays you cash for agreed sale price, and you receive an income-tax deduction

- The University of Alabama may use or sell the property

Benefits

- You receive cash from sale of property (sale price is often the original cost basis)

- You receive a federal income-tax deduction for the difference between the sale price and the fair-market value of the property

- The University of Alabama receives a valuable piece of property that we may sell or use to further our mission

Request an eBrochure

Which Gift Is Right for You?

Contact Us

W. Vance Bristow, Ph.D.

Assistant Vice President for Planned Giving

205-348-4770

Vance.bristow@ua.edu

The University of Alabama

355 Rose Administration Building, Box 870123

Tuscaloosa, AL 35487

Federal Tax ID Number: 63-6001138

© Pentera, Inc. Planned giving content. All rights reserved.

Disclaimer